ex works shipping terms revenue recognition

The terms are there to determine liability and when revenue recognition can take place between two parties. At the date of shipping the goods the Czech company has the invoice on hand ie the transaction will be.

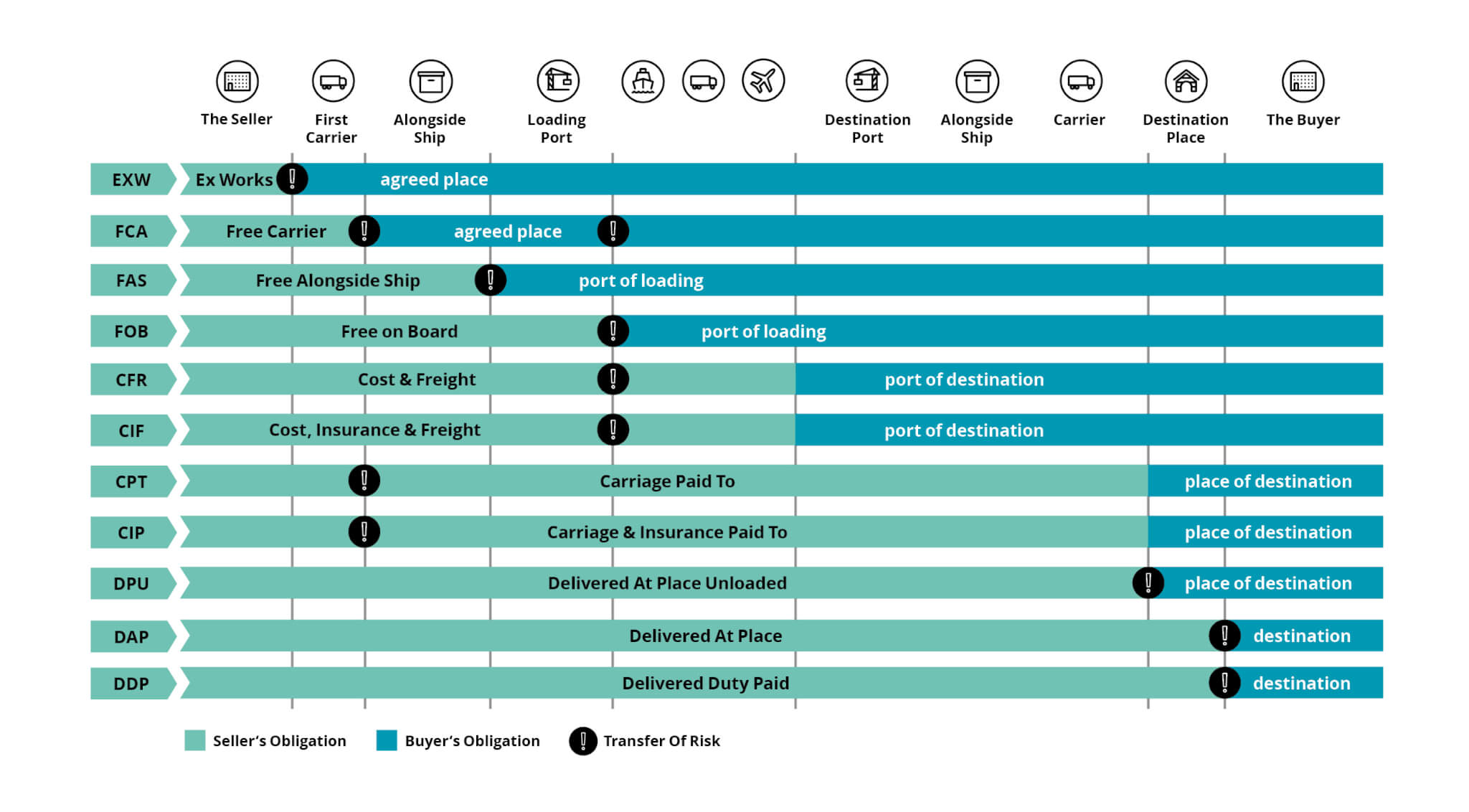

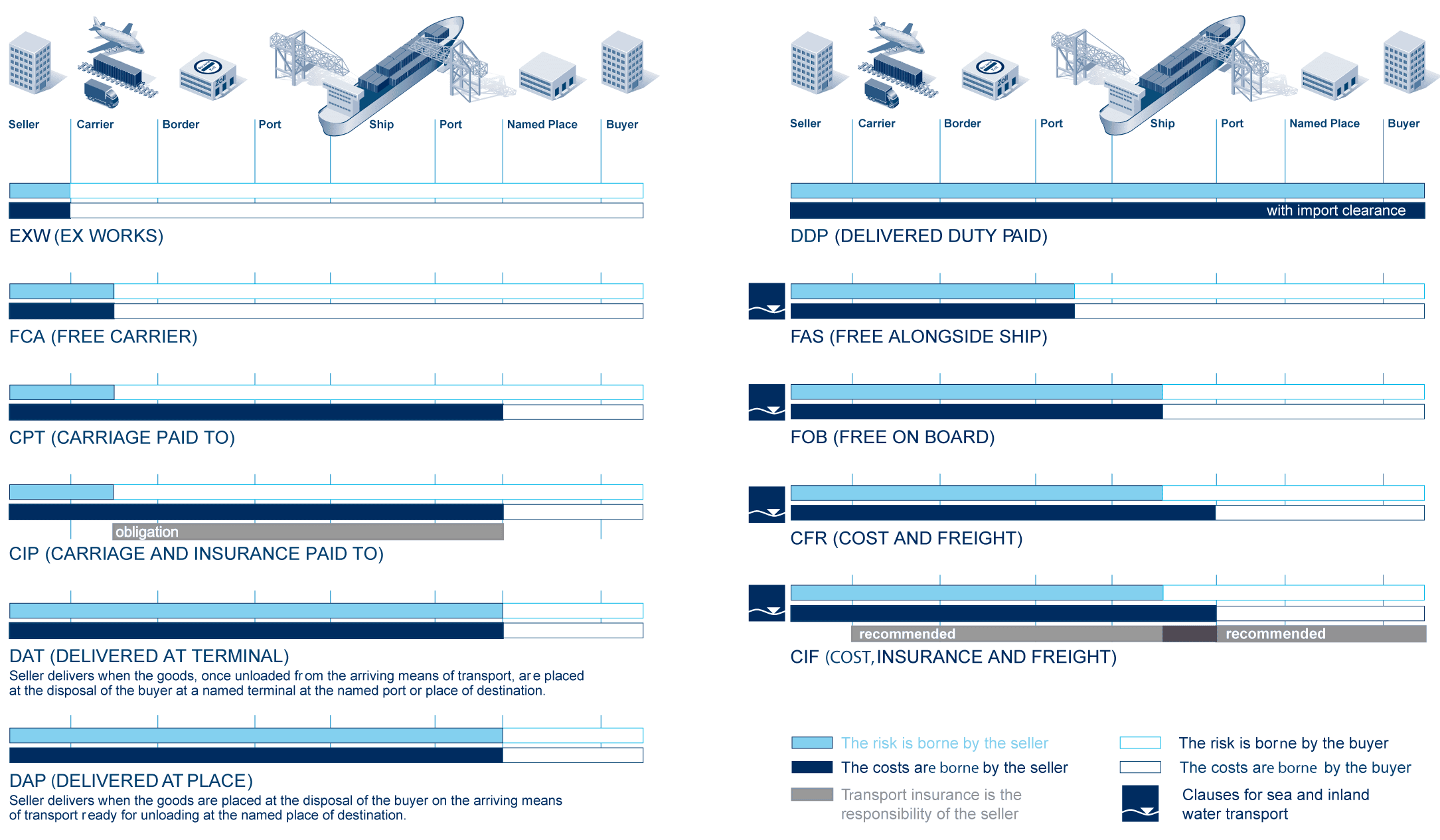

In case of CPT it should be recognised when it reaches the destination port and so on.

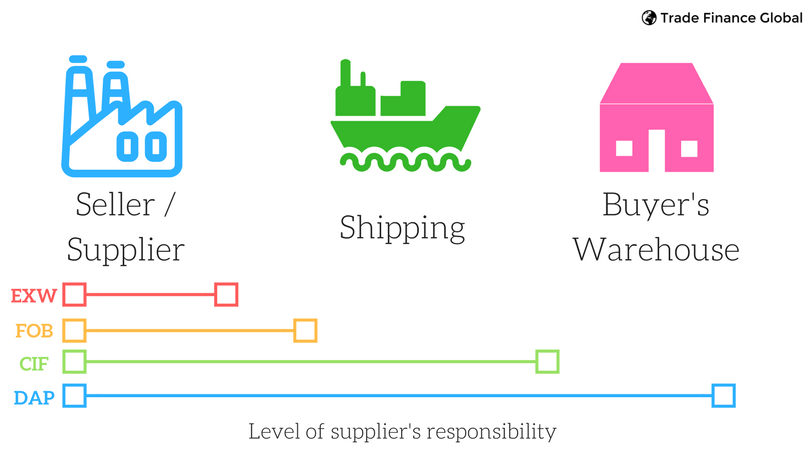

. Ex Works EXW is the Incoterms 2020 rule used to describe the delivery of goods by the seller at their place of business normally in their factory offices or warehouse. If the Incoterms is EXW Ex-works then the revenue should be recognised immediately. Ex works is the same as Freight on Board FOB Shipping.

The transportation and logistics industry includes companies associated with shipping railways airlines trucking and logistics and cruise lines. Customers generally pay a fee. When conducting international business its easy to get overwhelmed with the numerous shipping terms and then gain an understanding what is required by the buyer and the seller for each method.

The seller is responsible for the freight and insurance if desired and title passes to the buyer only on arrival. The buyer is responsible for loading the goods onto a vehicle even though the seller may be better. EXW Ex Works named place of delivery.

For example if the contract states the sale is covered by ExWorks Incoterms 2010 Rules then it is in effect a breach of contract to load the goods on the collecting vehicle contract with the freight company for the international movement etc. One of the first things I started to look at was our use of Incoterms Rules. All costs and liabilities are with the buyer.

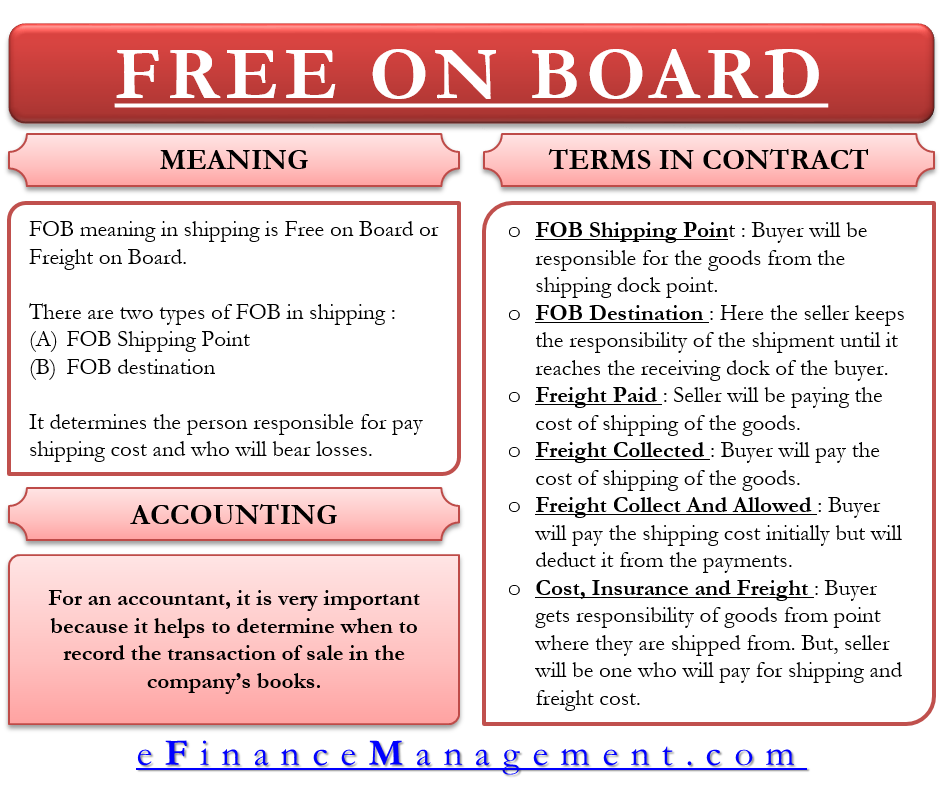

INCO Terms and Revenue Recognition INCO Term Revenue Recognition Location Trigger Document When You Can Invoice When Risk Transfers Ex-works plants loading dock Written notification to buyer that goods are ready for pick-up upon written notification of readiness to buyer once cargo is placed at loading dock and made available to buyers trucker. Delivery occurs when goods are placed for the buyers disposal without necessarily to be loaded. Freight on Board FOB Definition.

My clients requirements is that the revenue recognition should take place based upon the Incoterms. Revenue recognition shipment of goods Scenario. Ex Works sometimes shown as EXW or ExWorks is a widely used international shipping term or Incoterm.

Ex Works EXW Can be used for any transport mode or where there is more than one transport mode. A contract that either change the terms of or add to the rights and obligations. Ex-works terms make the seller responsible to place the goods at the disposal of the buyer at the sellers facilities or any other named place.

Under these terms goods are at the sellers risk until they arrive. As such they are expensed when incurred. Revenue recognition is an important part of business.

The two terms can be used interchangeably because they assume the same terms and agreement between the buyer and seller. The Point of Revenue recognition may change when the term of delivery is change it May be EXW Ex Work or CNF etc But the basic concept remains the same that is when the Performance obligation. Despite not being written for this purpose why do companies use Incoterms Rules for revenue recognition.

Overseas shipment and customs duty. What are EXW Shipping Terms. In Case of FOB Free on Board it should be recognised when it reaches the port.

If the loading operation is performed by the seller it is difficult for the buyer to. This rule places minimum responsibility on the seller who merely has to make the goods available suitably packaged at the specified place usually the sellers factory or depot. Ex Works EXW is an international trade term by which a seller makes the product available at a designated location and the buyer incurs transport costs.

We were using ExWorks as a default term for all exports EU and third country. And according to the definition of Ex-works transportation costs and associated risks are no longer a burden for the seller. The named place can be other than the seller premises.

The terms allocate the division of responsibility between the Shipper usually the. The shipper will likely be required to present an AWB or OBL. Buyer is not required to disclose any export information or details regarding the export of the goods.

When importing on Ex Works terms the buyer is responsible for the whole shipment from door to door. One key to implementing accurate revenue recognition of international transactions is in educating your personnel about these differences. Goods are invoiced to customers on CIFCPTDDU basis Carriage Paid To Named Place or Delivered Duty Unpaid at Named Place.

Definitions of these terms in accordance with the International Commercial terms Incoterms are listed below. However costs incurred related to shipping and handling do not meet the definition of an asset nor are they eligible for capitalization. The sales agreement incoterm is Ex-works - sellers premises.

The EXW term is never involved with an AWB or OBL. Freight on Board known internationally as Free on Board are the terms of a transaction within a contract. This makes the current accounting easy as the costs to ship the goods are normally matched against the revenue from the sale.

Revenue recognition page 39. Ex Works EXW How to manage inventory Just in Time Inventory System Inventory Cost Accounting Principles. INCOTERMS 2010 E _ Terms.

The shipping terms most commonly used in contracts between the Company and the customer for delivery of capital solar equipment are FOB Ex-Works and CIP. We shipped goods to a buyer last week in December and the shipment was delivered on Jan 3rd. The advantage of ex-works from a sellers standpoint is that the seller is allowed to recognize revenue once the product has been picked up or a contract has been signed.

The Revenue Recognition Transition Resource Group TRG has discussed various. I have just started a new role as an international trade compliance manager at a large well-established business. Major problems if used with a Letter of Credit.

Question on revenue recognition for a month-end shipment. The seller does not need to then load items onto a truck or ship and the remainder of the shipment is the responsibility of the buyer eg. Therefore the principles relating to the recognition of one entitys income should correspond to a certain degree with the recognition of another entitys purchase.

Get To Know Incoterms 2020 Oceanair Inc

Incoterms 2010 Comprehensive Guide For 2020 Updated

Incoterms 2020 Exw Spotlight On Ex Works Shipping Solutions

Delivered Duty Paid Incoterms Explained

Fob Meaning With Example Efinancemanagement

Difference Between Ex Works And Dap In Shipping Terms

New Incoterms 2020 And Their Impact On Accounting Dreport In English

Exw Ex Works Incoterms 2020 Rule Updated 2022 Free Podcast Pdf

Incoterms 2020 Introduction For Traders Globalior

Get To Know Incoterms 2020 Oceanair Inc

Incoterms 2010 Comprehensive Guide For 2020 Updated

Incoterms 2010 Comprehensive Guide For 2020 Updated

Incoterms 2010 Comprehensive Guide For 2020 Updated

Incoterms 2020 New Rules Incoterms Transport Logistics

Incoterms 2020 Exw Spotlight On Ex Works Shipping Solutions

Incoterms 2010 Icc Official Rules For The Interpretation Of Trade Terms

Ex Works Or Fob Instead Of Cif Or Cfr Five Reasons To Choose